APPROVE Financing

Welcome to the Business Financing Program by APPROVE

Lenders Compete...You Win!

Instead of working with one lender and wondering if you're getting a good rate, APPROVE leverages competition among a network of the nation's top lenders to ensure you're getting the lowest financing rates available.

APPROVE is a Business Finance Program that requires personal credit backing if the Business is < 10 years old or if the Business has low or no business credit.

In these circumstances, a Personal Credit Score of 600 (minimum) is required, and a Score of 670 (minimum) is recommended for better rates.

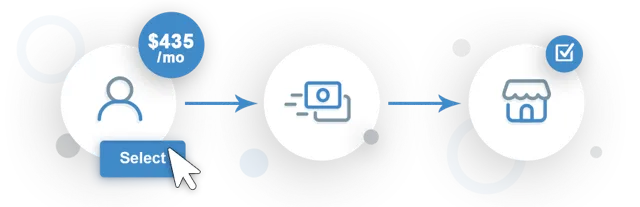

Here's how it works:

- SUBMIT APPLICATION: Choose the APPROVE Business Loan payment option on the checkout payment page and submit one easy online application in seconds.

- CHOOSE BEST OPTION: Approve shops for the best offers among many lenders. APPROVE lenders know they are competing, so they are motivated to work quickly and present their best offers. If approved, you will be contacted via email with up to the 3 of the best lender options for you to choose from. This can take from as little as 10 mins, up to 1 business day.

- ORDER IS SAVED: Your order will be saved on our shopping cart, so that you can always come back to the cart and complete your checkout via another payment method if you are not happy with your lender options, or if you were not approved for business financing.

Financing Equipment is Good for Your Business

- Conserve Your Cash: Conserving cash to cover expenses is huge for managing the ups and downs of business. Why deplete your cash reserves on large capital expenditures that can easily be financed when you can use that money for other investments in your business.

- Pay As you Earn: Equipment generates revenue. That's why you buy it. Financing lets you align the investment with the income generated over the life of the equipment.

- Manage Cash: Locking in fixed monthly payments helps you manage your books easier.

- Tax Advantages: Ask your accountant about taking advantage of the Section 179 tax deduction for financed equipment. This gives you the ability to deduct the full value of the equipment the year you buy if that may make sense for your business.

Start Financing Your Equipment Today

To begin the process of getting the equipment you need at affordable monthly payments, simply submit your application here.

One simple 60-second application could get you the equipment you need and the affordable monthly rate you want.